Latest News

“Information that is useful to you when thinking about your books and accounts”

– Rebecca Webster, Electric Accountancy founder

Our Latest News

Changing Accountants Is Easy Peasy!

Are you fed up with your accountant? Your accountant should be an investment that provides you with value for money; Your requirements change as your business develops and grows, and your accountant should keep up; An accountant should be approachable, friendly and...

Ten tips for business success

1. Get passionate If you can’t get passionate about what you’re doing then do something else instead. Without passion you'll lack the motivation and energy to drive your business forwards. With passion you can achieve almost anything. 2. Write down your goals Set...

45 Actions To Help You Collect Every Penny You Are Owed

Getting paid on time is vital for cash flow and business survival. It’s also important for the overall economy and speed of the UK’s economic recovery following the pandemic. At the start of 2021, £23.4 billion worth of late payments were owed to small businesses...

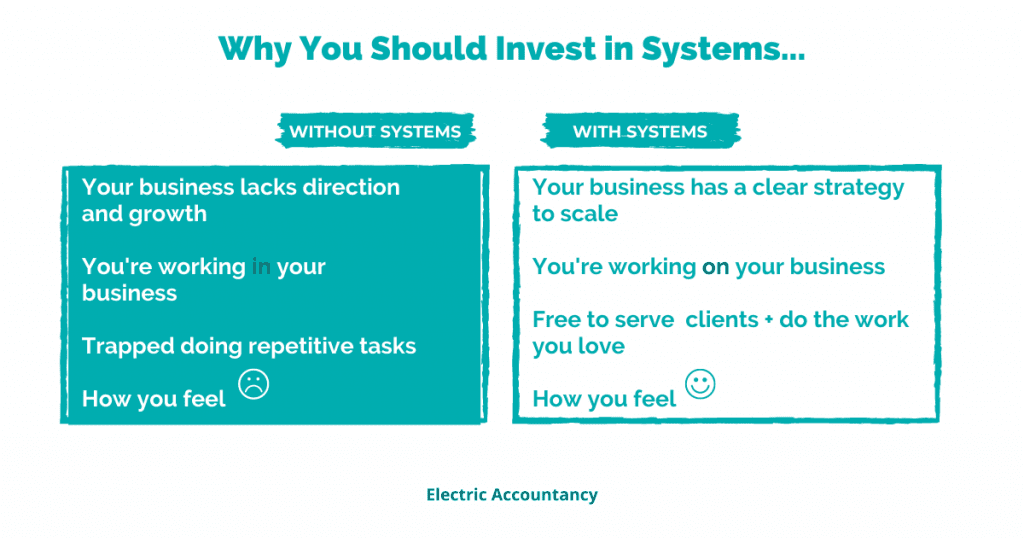

How to improve your business and increase its value

Successful businesses rely on systems rather than just people. Exceptional people are important, but if the business is only great because of the exceptional people, what happens when they leave, or when you need more of them? A business system is simply a...

How to create an innovative business

Innovation is vital if you want to move your business forward and into the future. Standing still isn’t an option in our fast-moving world and businesses that don’t innovate will ultimately fail. Making it happen isn’t always easy, but even small steps will put you...

52 Reasons Why Some People Are More Successful In Business Than Others

What do we mean by “successful”? Success means different things to different people. But usually, it’s some combination of these factors that most people want: More money More fun (or less hassle) Less time at work (more life) To make a positive impact on others...

Cash vs Profit: What’s The Difference & Which Is More Important?

It’s the age-old debate: cash flow or profit - which is the most important to a business? Before answering this, let’s look at what we mean by ‘Cash’ and ‘Profit’. What is Cash? In business, cash means the money that a business can access immediately or...

Understand And Manage Your Cash Position In 3 Steps

Without cash, a business eventually grinds to a halt. It’s the number 1 reason why so many businesses fail. However, there are 3 simple things that you can implement in your business today, which will put you in control of your cash. The more in control you are,...

Planning For Growth As A Small Business Owner

Growing your business is exciting but there’s a lot to think about. Time spent planning is never wasted. As a small business owner, there’s no greater joy than watching your creation thrive. As you start to experience success, it’s only natural to turn your...

Company Directors – Do You Know About Trivial Benefits?

1. Trivial Benefits For Employees You don’t pay tax on a benefit for an employee if all of the following apply: It costs £50 or less to provide (if it's over £50, the whole lot is taxed) It isn’t cash or a cash voucher It isn’t a reward for work or performance It...

Are You A Responsible Capitalist?

An increasing number of people want to buy from, work for, partner with, and invest in companies that are not solely profit-driven. Focusing on People, Planet and Profit is often referred to as the Triple Bottom Line, and is expected to become even more important...

Have You Checked If Making Tax Digital Applies To You?

Many businesses mistakenly believe that Making Tax Digital is just for some VAT-registered businesses. However, the MTD scheme is being expanded and will soon be compulsory for many other businesses, including: 👉 All VAT-registered businesses 👉 Millions of...

Electric Accountancy Joins The Good Business Charter

Electric Accountancy is proud to be one of the first Accountancy practices in the UK, and the very first in the East Midlands to be accredited by the Good Business Charter. We join companies such as St James’s Place Wealth Management, TSB Bank and The Association...

5 Useful Finance Tips For Businesses

Good financial health is crucial for business success, and this starts with careful financial management. However, many business owners delay the job of dealing with their finances - sometimes this is because the whole task of managing the finances is overwhelming;...

How To Maintain A Healthy Cash Flow

Cash flow is the lifeblood of a business. You need cash coming in regularly to continue operations and pay bills on time. Late customer payments or unforeseen costs can cause huge disruption. In addition, if you're scaling up, it's likely that you will experience a...

HMRC Records Nearly One Million Scams

Over the last year, HMRC has received 975,420 reports from the public about suspicious communications alleging to be from HMRC – an increase of 71% from the previous year. Over half of these scams relate to bogus tax rebates, but there was also a huge increase in...

7 Common Money Mistakes That Startups Make

Smart financial management is essential for all businesses. However, it can be difficult to get it right, especially during the startup stage. Poor financial planning the most common cause of startup failure, so the sooner you take ownership of your finances the...

What to Know Before Starting A Business

Most business owners who fail to get their business off the ground do so because they rush in without thinking things through properly. There’s much to learn about building a business from the ground up and turning it into a success. Some things you pick up along...

Are You A StartUp With Burning Questions?

Get an insight into the questions that Lincolnshire's innovative start-up businesses ask Business Growth Acceleration Spark Accelerator is a business growth accelerator developed and run by Rebecca Webster, Electric Accountancy’s founder, for the University of...

‘Tis The Season To Be Jolly? How To Party Tax-Efficiently

Treat your staff to a tax-free party ! If you hold a social event for your staff, then you may not need to report anything to HMRC or pay tax or National Insurance, so long as certain rules are met: The total cost including VAT, food, refreshments, entertainment,...

4 Tax-Saving Schemes Directors Need To Know

Four legitimate schemes that won’t land you in hot water with HMRC, but which let you extract £20,870 from your company tax-free (updated for 21/22). 1. TRIVIAL BENEFITS You don’t pay tax on a benefit for an employee if all of the following apply: It costs £50 or...

What next?

Book a meeting with Rebecca Webster, Electric Accountancy founder. Let’s talk about your business and start putting an action plan together.

You can then decide if you want our help to implement it.

“Rebecca has provided us all with invaluable advice and support. Thank you!”

- Harriet Foster-Thornton, The Wild Shepherdess